İŞBANK

ANNUAL REPORT 2014

22

İŞBANK AND

ITS ACTIVITIES

IN 2014

İşbank maintains a sector-leading position

in terms of total loans and shareholders’

equity; it is also the leader among Turkish

private banks in terms of total assets,

deposits and branch network.

Thanks to the growth achieved in 2014,

İşbank’s total assets rose to TL 237.8 billion

and total loans went up to TL 155.3 billion,

while total deposits amounted to 133.6

billion.

While expanding the Bank’s business

volume, İşbank also continued to focus

on asset quality and profitability. As a key

player in Turkey’s economy and the Turkish

banking sector, İşbank has positioned itself

as “The Bank Closest to Customers.”

İşbank’s total assets climbed by 13.0% to TL 237.8 billion

in 2014.

Asset Composition (%)

2014

2013

Cash and Banks

10.9

11.7

Securities

17.2

17.5

Loans

65.3

64.1

Associates & Subsidiaries

4.0

3.7

Other Assets

2.6

3.0

Total

100

100

Liability Composition (%)

2014

2013

Deposits

56.2

57.5

Funds Borrowed and Money Market Funds

(*)

24.7

23.7

Other Liabilities

6.8

7.6

Shareholders’ Equity

12.3

11.2

Total

100

100

In 2014, İşbank continued to expand

the domestic and international service

network. With 49 new branches starting up

operations, the domestic branch network

expanded to 1,333. With the addition of

Baghdad/Iraq, Tbilisi/Georgia, Prizren/

Kosovo, Edmonton-London/UK and Arasta-

Nicosia/T.R.N.C. branches, the Bank now

operated through 25 overseas branches.

In 2014, İşbank increased its total assets by

13.0% compared to the previous year, to TL

237.8 billion.

The upward trend in the share of loans in

total assets continued in 2014, rising to

65.3% by year’s end.

İşbank’s total loans amounted to TL 155.3

billion, up 15.2% in 2014.

İşbank maintained its leading position in

the sector in terms of total loans in 2014.

Paying utmost attention to maintaining

diversification in the Bank’s loan portfolio in

terms of loan types, İşbank’s loan portfolio

is comprised of 27.3% retail loans and

72.7% corporate, commercial and SME

loans.

The ratio of non-performing loans (NPL) to

total loans continued to decline in 2014.

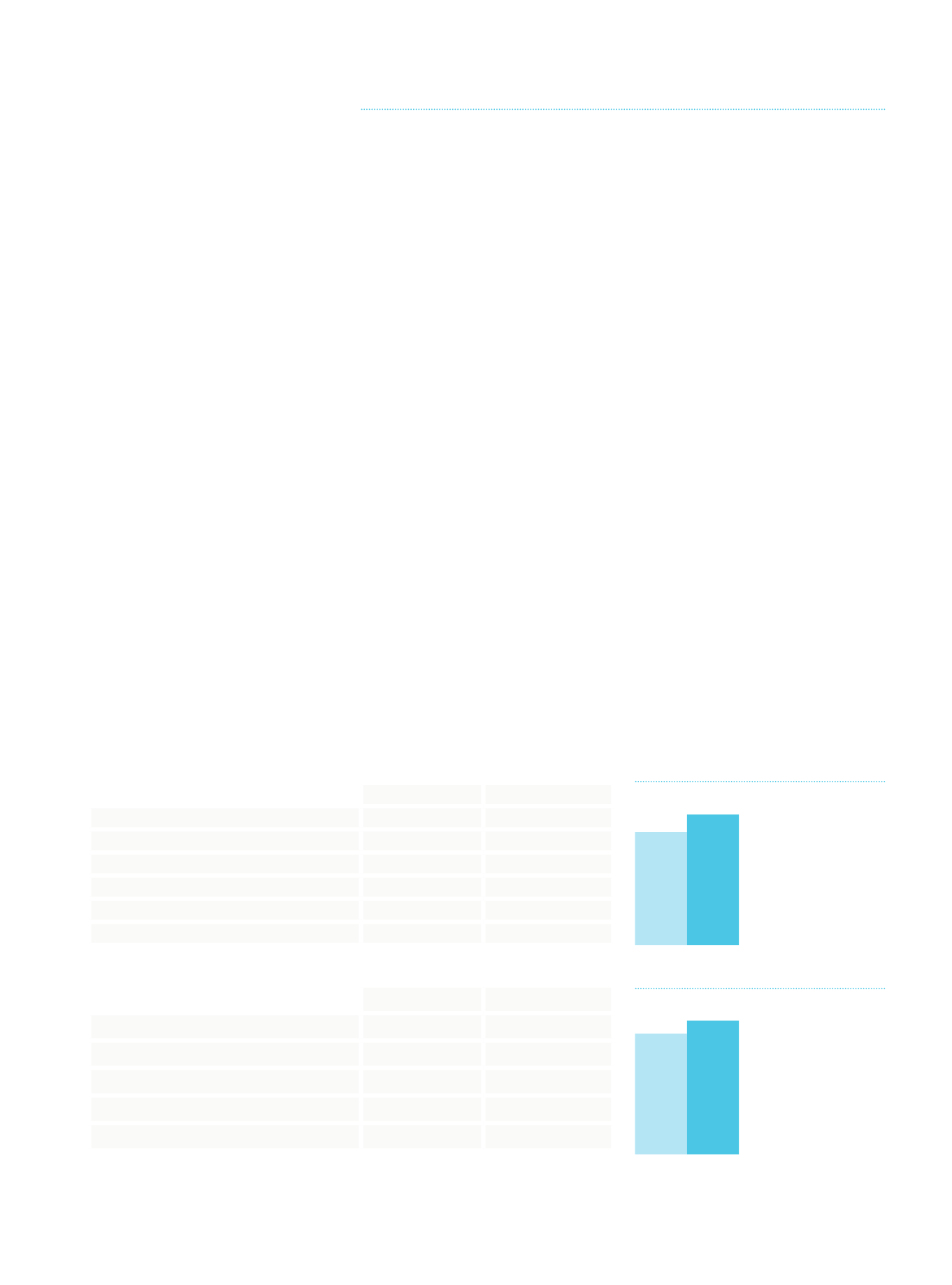

Total Deposits

(TL million)

Total Loans

(TL million)

2013

134,843

2014

155,315

2013

120,975

2014

133,551

15.2%

İşbank expanded

its total loans

by 15.2% in 2014.

10.4%

İşbank’s total

deposits rose to

TL 133,551 million.

(*)

Includes borrowing instrument issues in TL, FC and subordinated loans.