The Economic Outlook in 2009

THE GLOBAL ECONOMY

A year after the deepening of the crisis, global economic activity is slowly increasing and financial conditions are returning to normal.

Developments in 2009

Global economy began to recover in the second half of 2009.

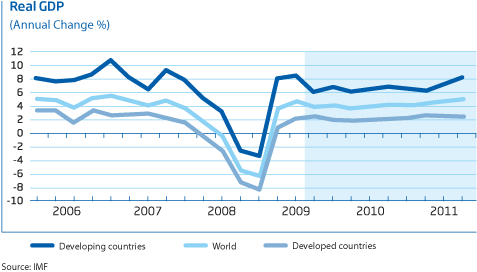

The indicators regarding the second half of 2009 show that the recovery of the global economy, as a result of the loose monetary policies and fiscal stimulus put into practice against the deepest crisis since the Great Depression, is underway. A year after the deepening of the crisis, global economic activity is slowly increasing and financial conditions are returning to normal.

Global interest rates were at low levels in 2009.

As of year-end 2009, short-term interest rates were at 0% - 0.25% in the USA, 1% in the Euro Zone, and 0.10% in Japan.

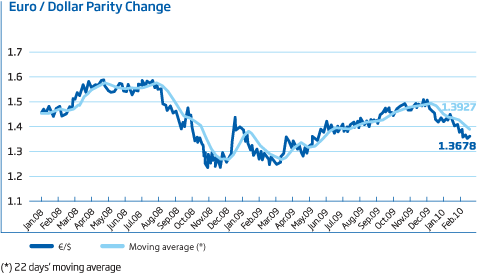

The dollar fluctuated against major currencies due to expectations regarding the global financial markets, debates about its international reserve currency status, changes in the global risk perception and the macroeconomic data disclosures. After having risen to 1.5139 during 2009, euro/dollar parity dropped to 1.4316 at year-end.

Remaining below USD 40 per barrel at year-end 2008, the spot market price of Brent oil rose to USD 45 per barrel during the first quarter of 2009 due to the ongoing uncertainties regarding the global economy. Starting from the second quarter, the spot price of oil started to climb as the global economy began to show the first signs of recovery. At year-end 2009, the spot price of Brent oil reached USD 78 per barrel.

IMF forecasts the global economy to grow by 3.9% in 2010.

2010 Forecasts

Recovery of global economy is expected to continue in 2010.

Economic indicators like the high rates of unemployment worldwide, the tight credit conditions, and the deterioration in fiscal balances suggest that the global economic recovery would be gradual.

IMF forecasts that the global economy will grow by 3.9% in 2010.

The fundamental risk regarding the exit strategies is “timing”.

Implementing the exit strategies prematurely might halt the economic recovery. On the other hand, keeping the monetary and fiscal support for an extended period might raise concerns about the solvency of the public sector and moral hazard.

Thus, the following have a crucial role in ending loose monetary and fiscal policies:

- Following a coordinated strategy on a global scale,

- Not acting before the recovery clearly has taken hold,

- Adopting a “strong, balanced, and sustainable” economic growth model based on a more balanced global demand in order to avoid similar global crises in the future.

A rise in interest rates is not foreseen before the economic recovery gains consistency globally.

Despite the fact that the relative upward trend in economic activity has caused oil demand to increase, it is still below the demand levels of previous years. This will prevent oil prices from skyrocketing. In 2010, Brent oil prices are expected to remain around USD 75 per barrel on average.