İşbank in 2009

Capital Markets

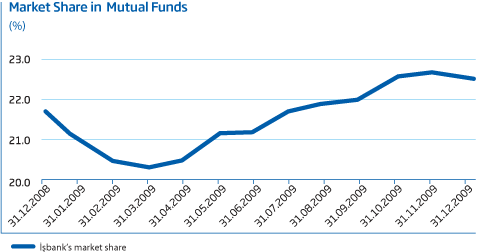

As of year end 2009, İşbank had a 22.5% market share in the mutual funds market, 7.4 percentage points ahead of its closest competitor. İşbank’s mutual funds reached a portfolio size of TL 6,776 million.

Leading bank in the development of capital markets in Turkey

İşbank is without a doubt the leader and pioneer of capital markets in Turkey.

İşbank continued to increase its strength on mutual fund, stock, bond & bill, repo, and Eurobond trading in capital markets during 2009 through:

- New product and services designed according to market conditions, forecasts, and customer preferences,

- A competitive pricing policy,

- An ability to offer uninterrupted and high-quality services from all service channels.

İşbank has a 22.5% market share in mutual funds.

In 2009, in the mutual funds market that expands with changing investor preferences, İşbank grew its funds above the sectoral average.

İşbank expanded its funds portfolio and maintained its leadership through the year with a total of 20 mutual funds and 8 capital protected and capital guaranteed funds, diversified according to different risk/return profiles, in the mutual funds market. As of December 31, 2009, the Bank had a 22.5% market share in the mutual funds market, 7.4 percentage points ahead of its closest competitor. İşbank’s mutual funds reached a portfolio size of TL 6,776 million as of year end 2009.

Money Box Fund: Largest fund in terms of investors

With 147,000 participants, İşbank’s “Money Box Fund” is the Type-A fund most preferred by investors in Turkey and is the first of its kind in the country to be targeted specifically at children. In 2009, this fund grew above the average sectoral rate for mutual funds with a 55.0% growth rate and reached a portfolio size of TL 185 million.

With a 7.9% market share in the volume of share trading in 2009, İş Yatırım, İşbank’s subsidiary, successfully preserved its leading position among the 89 brokerages active in the ISE equities market.

Leader in the volume of share trading

With a 7.9% market share in the volume of share trading in 2009, İş Yatırım, İşbank’s subsidiary, successfully preserved its leading position among the 89 brokerages active in the ISE equities market.

Highest ISE Bond and Repo Markets Trading Volume

İşbank had a trading volume of TL 825 billion in 2009 in the ISE bond and repo markets, and was able to maintain its leadership.

İşbank is the only local bank offering international custody services.

İşbank has provided custodial services to investors residing in foreign countries since 1992. The Bank offers service to non-resident customers in settlement and custody for securities, exercise of shareholding rights and participation in annual general meetings, cash management, foreign exchange transactions, and tax representation and consultancy.

İşbank is the leader in asset custody service.

İşbank is the first bank to get “Asset Custody Agency” authorization from the Capital Markets Board. The Bank manages 40% of the market’s custody services for assets subject to the management of individual portfolios of asset management companies.

TurkDEX brokerage services are becoming more widespread.

The brokerage services offered from 50 İşbank branches and via the Internet Branch by the end of 2008 continued to expand in 2009. As of year-end 2009, the number of İşbank branches from which TurkDEX services are provided reached to 141, and further efforts to expand are ongoing.

Number of Gold Accounts reached almost 60,000.

Offering gold trading services to customers through investment accounts and Gold Accounts, İşbank increased the number of these accounts to 59,250 and the size of customer custodies to 8.7 tons of gold during 2009.

Also in 2009, İşbank offered gold regular purchasing order products to customers, enabling the Bank to continue to lead the market in gold banking.

İşbank continued to improve its products and services while bearing in mind not only the current economic environment, but the demand and expectations of investors as well.

iPhone application “İş’te Yatırım” Portal

In March 2009, İşbank rolled out the “İş’te Yatırım” application for iPhones.

İş’te Yatırım was the first iPhone application to provide live ISE data. In July 2009, the content offered to customers was expanded through the addition of international stock indices, currency exchange rates, parities, and gold prices.

As of year-end 2009, the İş’te Yatırım iPhone application has over 16,000 users, the majority of whom are in Turkey.

“Return Wizard” at “İş’te Yatırım” Portal

The Return Wizard application was released after completion of its development in November 2009. The Return Wizard was designed as an application to enable İş’te Yatırım Portal users to compare returns in a quick and easy to understand manner.

The Return Wizard supports the Multi Touch feature of Windows 7, the operating system released by Microsoft in 2009, and has been a success story in the launching of Windows 7. The Wizard has attracted wide interest as the first financial application to support the multi touch feature.

As of December 2009, İşbank has increased the total value of its capital protected and capital guaranteed funds to TL 145 million, translating into a 22.7% market share.

Capital protected and capital guaranteed funds offered to public

İşbank completed the public offering of capital protected and capital guaranteed funds including various underlying assets in order to meet customers’ diverse investment needs during the current low interest rates and fluctuating market environment.

In 2009, a total of 8 funds indexed to underlying assets such as gold, ISE 30 Index, USD/TL, and EUR/TL have been offered to the public. As of December 2009, İşbank has increased the total value of its capital protected and capital guaranteed funds to TL 145 million, translating into a 22.7% market share.

İşbank aims to develop its leadership in Turkish capital markets.

İşbank’s primary objectives in its capital markets business line are to carry the strength and continuous synergy created with its subsidiaries to the highest level, be innovative in developing products and services, and to lead the development of the Turkish capital markets.