İşbank in 2009

Alternative Distribution Channels

In 2009, İşbank customers carried out 61.2% of their banking transactions via alternative distribution channels.

İşbank is among the most successful providers of alternative distribution channels in Turkey.

İşbank makes a difference in the banking sector with its practices and capability to successfully blend the use of technology, reaching customers, and serving customers. In 2009, İşbank customers carried out 61.2% of their banking transactions via alternative distribution channels.

Lowering the costs is one of the most important aims of İşbank’s long-term transformation program. The expansive and intensive improvement efforts conducted within this program, primarily for the branch network, have aimed to bring operational costs down and to improve productivity via extensive deployment of technology.

The gradual shift of the operational burden on the Bank’s physical branch network to alternative distribution channels has been a major priority in meeting this objective.

In addition to the expansive branch network spread throughout Turkey, İşbank provides uninterrupted and diversified banking services via its

- Internet Branch,

- Bankamatik (ATMs),

- Telephone Branch / Videophone Branch,

- Call Center/ Video Call Center,

- İşCep,

- İşWap, and

- Netmatik (Kiosks).

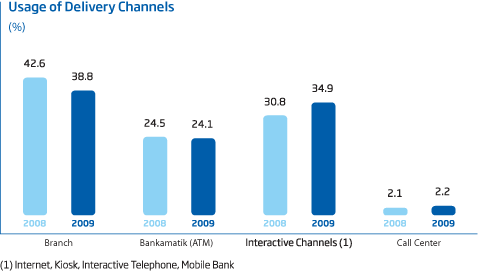

Alternative Distribution Channels utilization rates

İşbank steadily expanded its alternative distribution channel products and service offerings along with transaction volumes in 2009.

The transfer of banking activities from branch channels to alternative distribution channels accelerated; while the efforts to increase the variety and number of transactions performed via alternative distribution channels continued intensively.

As a result of these initiatives, the rate of transactions performed at branches dropped to 38.8% in 2009 from the 42.6% level of 2008. The rate of transactions performed through interactive channels, call centers, and ATMs for the same period rose to 61.2%, from 57.4% in the previous year.

With the largest ATM network in Turkey, İşbank participated in the “Common ATM” platform as of October 1, 2009.

Important developments on ATMs during 2009

- In 2009, the total number of ATMs reached 3,591, of which 1,890 are ATMs and 1,701 are ATM (+).

- The ability to return change in coins and read barcodes has now been added to the majority of ATMs.

- As of October 1, 2009, the ATM Debit Card Sharing Platform has been established under the coordination of the Interbank Card Center (BKM). With the largest ATM network in Turkey, İşbank is participating in the “Common ATM” platform.

- As of year-end, the Bank has received commissions over TL 1 million via the Common ATM platform.

Internet Branch

- The application process for commercial internet banking has been simplified. Transactional capability for both member merchants and commercial loans in particular has been improved.

- In response to customer needs, the retail Internet Branch has been enriched with new investment transaction functionalities such as fund bouquet, regular mutual fund purchasing and gold account transactions.

- The application process for New Generation Housing Loans has been renewed based on user experience feedback in order to allow for easier and faster submission via the internet.

Interest in mobile delivery channels has grown with the improvement and popularization of mobile phones and the arrival of the 3G infrastructure. The capabilities of İşCep have been improved in 2009 in parallel with this trend.

Mobile Banking channels: İşCep and İşWap

Interest in mobile delivery channels has grown with the improvement and popularization of mobile phones and the arrival of the 3G infrastructure. The capabilities of İşCep have been improved in 2009 in parallel with this trend.

The visual and content richness of wap.isbank.com.tr, İşbank’s first mobile banking channel serving customers since 2000, has been improved and wap.isbank.com.tr has been refreshed as a portal in 2009. The İşWap service allows users to access information about the Bank’s products and services and to quickly complete retail loan and credit card applications. Customers using the Wap Branch accessed through İşWap are able to complete banking transactions with speed and ease.

Mobile Key

The communiqué for additional security measures in internet banking in Turkey went into effect on January 1, 2010. Accordingly, the Mobile Key feature, allowing customers to create One Time Passwords through software they can install on their mobile phones, was launched in November 2009.

İşbank customers are able to not only easily access the Internet Branch, İşCep, and Wap Branch via Mobile Key, but also withdraw money card-free from ATMs.

Telephone Branch

With the switch in Turkey to the 3G infrastructure, İşbank has begun offering video call service to its customers via Telephone Banking and Call Center at 444 02 02.

Call Center

112,889 calls have been made and 70,948 customers have been contacted via the Call Center within the scope of marketing, promotional, and informational activities conducted in 2009. The success rate for sales calls has been 30%.

Portals: Maximiles and Sihirli Ada

Both maximiles.com.tr and sihirliada.com.tr have gone live on the web in 2009. While maximiles.com.tr promotes the Maximiles card and allows customers to purchase plane tickets using the miles they have earned, sihirliada.com.tr appeals to children, the future customers of İşbank.

Multi-channel Banking Vision

In light of its multi-channel banking vision, İşbank will continue to improve the services offered through alternative distribution channels continuously changing and developing in parallel with İşbank’s objectives to:

- offer a wide range of services to customers from all contact points,

- effectively meet customer needs.