The Economic Outlook in 2009

TURKISH ECONOMY

Although the weakness in domestic demand in the first quarter of 2009 weighed on the economy, tax cuts implemented during the second and third quarters slowed down the decline in private consumption expenditures.

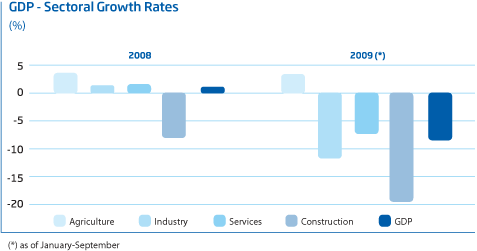

The economy contracted in 2009.

In Turkey, the negative effects of the global crisis were felt most acutely in the real sector. A decrease in demand from the EU, Turkey’s largest export market, has caused manufacturing in the export sector to shrink significantly, resulting in reduced employment. Furthermore, an increase in the global risk perception has toughened the financing conditions for the real sector.

In 2009, production, consumption, and investment decisions were postponed due to the decrease in economic predictability in Turkey, as well as experience acquired from previous crises. The Turkish economy contracted by 14.7%, 7.9%, and 3.3% in the first, second, and third quarters of 2009, respectively; this translated into a contraction of 8.4% for the first three quarters of the year.

Although the weakness in domestic demand in the first quarter of 2009 weighed on the economy, tax cuts implemented during the second and third quarters slowed down the decline in private consumption expenditures.

Looking at the year in general, the current account deficit contracted due to the decline in the foreign trade deficit. A review of the financing of the current account deficit showed that capital inflows to Turkey remained significantly below the previous year’s level.

Beginning in November 2008, the Central Bank of the Republic of Turkey (CBRT) has steadily lowered short-term interest rates from 16.75% to 6.50%.

In 2009, budget performance deteriorated compared to previous year.

Rapid increase of current transfers in the first quarter of 2009 and the limited growth in tax revenues as a result of contraction in economic activity have been the main factors to have a negative impact on Turkey’s 2009 budget performance.

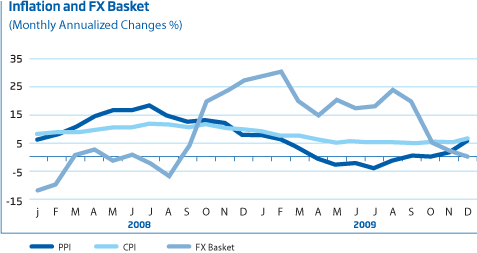

Weakening in domestic demand in 2009 has created downward pressure on inflation.

As of year-end 2009, consumer price index (CPI) rose by 6.53% and producer price

index (PPI) increased by 5.93% annually. In addition to the base year effect, fluctuations in commodity prices, primarily oil, are expected to be reflected in inflation rates in 2010.

CBRT lowered policy rates in 2009.

Beginning in November 2008, the Central Bank of the Republic of Turkey (CBRT) has steadily lowered short-term interest rates from 16.75% to 6.50%. Weak demand, worsening employment conditions, and uncertainties in the global economy have played a significant role in the rapid lowering of short-term interest rates.