İşbank in 2009

Retail Banking

The fundamental strategy of İşbank’s retail banking business line is to be “the Bank closest to customers.”

It is İşbank’s objective to offer the perfect customer experience at all stages of life.

The fundamental strategy of İşbank’s retail banking business line is to be “the Bank closest to customers.”

Acting with the guiding principle of “Turkey’s Bank,” İşbank develops customer centric solutions for millions of customers from all segments of society using its advanced technological infrastructure and highly capable human resources and offers a range of products and services that provide the maximum added value to customers.

A wide network of branches, a customer centric orientation, highly skilled human resources, innovative products and services that meet customer needs and expectations, and multi-functional alternative distribution channels are the main factors that make İşbank the bank closest to customers in retail banking.

Customer information is extremely valuable in retail banking. For this reason, İşbank places great importance on customer analytics. In order to get to know its customers better and to contribute to effectively managing relationships with them, İşbank has begun using analytical models such as segmentation, life-long value, customer churn, and next best product model in creating a comprehensive customer strategy.

Lifecycle Strategies in Banking: İşbank from childhood to retirement

Children in Turkey are introduced to İşbank very early in their lives. Child Account and Money Box Fund, one of the most prestigious investment funds of Turkey, allows young individuals to make contact with İşbank in their childhood years.

Children introduced to İşbank in the first stages of life begin to carry out their banking transactions on their own between the ages of 12 and 18 through the First Signature Account. The First Signature Account allows young customers to bank with İşbank until they enter university.

The “University Banking Package at İş” is the answer to all financial and banking needs during the young adult years. The University Credit Card at İş is the first step in the life-long credit card relationship. İşbank aims to maintain the relationships established with credit card holders during their university years as they progress through life. With that goal in mind, İşbank updates the credit limit of cardholders upon their graduation.

İşbank serves customers with a wide range of retail products throughout their professional lives and continues to stand by them during their retirement years. İşbank provides retail banking services with increased added value through the “Pension Package” to customers during their retirement.

Relationship Banking: For deepening and sustaining banking relationships...

İşbank focuses on establishing and sustaining customer relationships based on long-term and mutual returns. Therefore, İşbank has implemented relationship banking applications and practices across various channels of its retail banking operations. İşbank actively implements new customer acquisition, welcome, activation, promotion, loyalty, and re-acquisition programs. The Bank tries to make sincere contact with newly acquired customers while promoting the use of its products and channels. İşbank also implements systematic marketing campaigns in order to deepen relationships with existing customers, retain high-potential customers, and motivate low-activity or inactive customers.

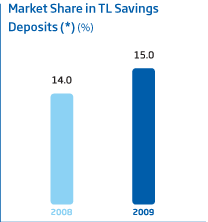

İşbank has maintained its leadership position in both total deposits and TL savings deposits among privately owned banks. The Bank had a 15.0% market share for TL savings deposits and a 14.0% share for total deposits. (*)

İşbank maintained its leading position in deposits among privately owned banks in 2009.

In 2009, İşbank outperformed the sector in terms of both total deposits and TL savings deposits.

İşbank has maintained its leadership position in both total deposits and TL savings deposits among privately owned banks. At year-end 2009, İşbank’s total deposits reached TL 72.2 billion, while TL savings deposits stood at TL 30.0 billion. The Bank had a 15.0% market share for TL savings deposits and a 14.0% share for total deposits. (*) With its strong brand and extensive branch network, İşbank is a trustworthy and safe place for savings of customers across all segments. İşbank continues to develop its deposit base with the philosophy that “sees the customer as its focus.”

Retail cash management products: innovative solutions aiming to ease the lives of individuals

İşbank offers and continually improves the quality of innovative cash management products that individuals need in their daily life.

As of year-end 2009, İşbank intermediates bill payments for 342 institutions. Today, bill payment is at the top of high-volume retail banking transactions and being able to pay bills hassle-free is crucially important.

The Unlimited Automated Service – SOS allows customers’ automated payments to be made from current accounts to which the automated payment order is linked, as well as from liquid funds and overdraft accounts within customers’ investment accounts linked to these current accounts. The number of SOS orders increased by 48% in 2009 to a total of 302,576. The number of orders submitted for the Maximum Account, which allows the automated purchase of funds with deposits above a certain balance in the current TL account, rose by 187% to 120,190.

İşbank has continued to provide a variety of advantages to both homeowners and lessees, with the “Rent Package” service when paying and collecting rent through banks, as per the legal regulations on rent payment.

Developments in salary payment

As of year-end 2009, İşbank intermediated the wage and salary payments of around 1.3 million people.

Customers with wage and salary agreements can take advantage of various İşbank services and are considered to be a significant segment and target audience for marketing of retail banking products. Special offers, products, and services targeted to customers with automated salary payment contribute to the loyalty of these customers to İşbank.

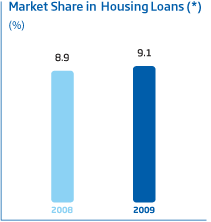

In 2009, regarding housing loans, İşbank has offered new products to its customers and diversified its distribution channels especially via the Housing Loan Call Center (444 24 68), which can also function via 3G - the most advanced mobile phone technology in Turkey.

İşbank’s total housing loan volume reaches TL 4.3 billion.

İşbank’s total volume for housing loans grew to TL 4.3 billion by supporting projects under construction, reinforcing relationship with real estate agents and creating solutions tailored to a wide range of customer needs.

İşbank has diversified the distribution channels for housing loan applications by accepting applications via the Housing Loan Call Center (444 24 68), which can also function via 3G - the most advanced mobile phone technology, www.isteevim.com.tr and web sites of selected real estate agencies.

The Appointment Center application allows customers who visit www.isteevim.com.tr to review detailed information on new generation housing loans or to request an appointment at any İşbank branch of their choice on a date they prefer.

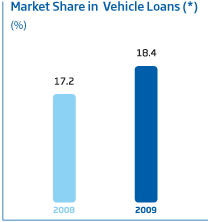

İşbank is the market leader in vehicle loans with a share of 18.4%. (*)

As of year-end 2009, İşbank raised its vehicle loans market share to 18.4%, and became the market leader. (*) This was achieved through campaigns and cooperation as per the vehicle loans for certain automotive brands active in Turkey.

İşbank is the market leader among privately owned banks in general purpose consumer loans.

İşbank continues to be the market leader among privately owned banks in general purpose consumer loans with a volume of over TL 5 billion and market share of 12.1%. (**) İşbank’s objective is to further strengthen its position in the retail credit market.

İşbank offers individualized solutions to customers with diverse needs through İşbank Maximum Card, Contactless Maximum Card, and Maximum Virtual Card products.

Card payment systems at İşbank

With over 5 million credit cards issued, TL 28.6 billion in total credit card revenue, and a 14.1% market share based on revenue, İşbank is a key player in the card payment systems market in Turkey.

İşbank offers individualized solutions to customers with diverse needs through İşbank Maximum Card, Contactless Maximum Card, and Maximum Virtual Card products.

Maximiles: New member of the İşbank card payment services portfolio

İşbank expanded its product range during 2009 by launching the new “Maximiles” credit card. This newcomer functions with a frequent flyer program infrastructure and aims to offer a diverse range of customized options to customers.

Maximiles credit cards offers customers not only the chance to earn MaxiPoints from Maximum member merchants, but also the opportunity to earn MaxiMiles from domestic and international shopping transactions and to use these MaxiMiles when purchasing plane tickets.

Customer Relationship Stages in credit cards business

Credit card customers were segmented based on the stages of their relationship with the Bank, and different campaigns and offers were provided to customers at various stages. İşbank, that also conducts regular customer analysis in order to promote the prevalent use of Maximum Card, maximize portfolio return, and manage this return in the most effective manner, arranges special campaigns to increase customer affiliation and profitability.

Below is a summary of headlines from the developments in İşbank’s card payment services during 2009:

- Credit card applications can now be submitted via SMS and ATM channels. In addition, detailed information about the customers for their applications can be received via the homepage of the İşbank website, the Internet Branch, and Interactive Telephone Banking (444 0202). In addition, İşbank accepts Quick Credit Card Applications from these channels.

- KGS booths at bridges and toll roads have been added to the list of merchants where low-amount transactions can be completed using İşbank’s contactless credit card product. As a result, customers’ low-amount contactless transaction volume has been increased and customer satisfaction has been improved.

- As part of the “81 Forests in 81 Cities” Project, one of the largest environmental campaigns in Turkey, customers can now contribute to the TEMA foundation by choosing “A Sapling Planted in My Name” instead of “MaxiPoints” when they request to receive their İşbank account statements electronically instead of via regular mail.

The number of private pension account products sold by İşbank increased by 19.2% to 307,662 through campaigns and sales initiatives conducted throughout 2009.

Synergistic collaboration with subsidiaries in non-life and life insurance products

İşbank works in close cooperation with Anadolu Hayat Emeklilik and Anadolu Sigorta, each of which are leading institutions in their fields. With this collaboration, İşbank offers a wide range of non-life and life insurance products to its customers.

The Unemployment Insurance service offered to cash, vehicle, and house loan customers during last year through the İşbank-Anadolu Hayat Emeklilik collaboration was expanded to credit card customers as Credit Card Support Insurance.

More than 307,000 new private pension accounts

Aiming to establish a long-term relationship with customers, the private pension account is a product that strengthens customer loyalty. İşbank branches, acting as Anadolu Hayat Emeklilik agencies, offer besides private pension products, many life insurance products. The number of private pension account products sold by İşbank increased by 19.2% to 307,662 through campaigns and sales initiatives conducted throughout 2009.

Coordination with Anadolu Sigorta on all non-life insurance products

İşbank carries out its non-life insurance activities in full coordination with Anadolu Sigorta. Accordingly, various joint campaigns and projects were conducted during 2009.

(*) Market shares are based upon monthly sectoral data (including participation banks, and development and investment banks) published by the Banking Regulation and Supervision Agency and are calculated excluding interest accruals and rediscounts.

(**) Market shares are based upon monthly sectoral data (including participation banks, and development and investment banks) published by the Banking Regulation and Supervision Agency and are calculated excluding interest accruals and rediscounts. General purpose consumer loans include loans categorized under “Others” and overdraft accounts.