İşbank in 2009

In General

With its steady performance in all its business segments, İşbank showed an exemplary sustainability performance in 2009.

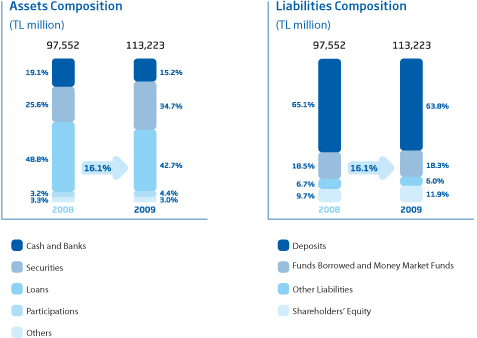

- At year-end 2009, İşbank reached TL 113.2 billion in asset size, registering 16.1% growth.

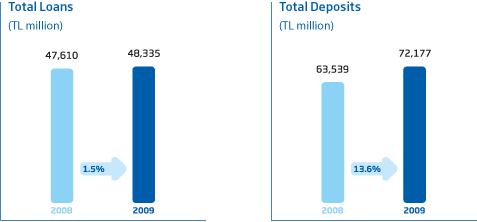

- Total lending was up 1.5% at TL 48.3 billion.

- At year-end 2009, İşbank’s total deposits reached TL 72.2 billion, while Turkish Lira savings deposits increased to TL 30.0 billion. The Bank’s market share in savings deposits is 15.0%, and 14.0% for total deposits. (*)

- İşbank’s Corporate Banking cash loans portfolio was up by 7.7% in 2009.

- With over 5 million credit cards, a total of TL 28.6 billion in credit card turnover, and a 14.1% market share based on turnover, İşbank is a significant player in the card payment market in Turkey.

- The number of Private Banking customers at İşbank surpassed 36,000 in 2009. The total amount of customer assets managed by İşbank as of year-end 2009 is over TL 25 billion.

- İşbank, always a leader in the capital markets arena, has 22.5% market share in investment funds with an investment funds portfolio worth TL 6,776 million.

- Once again, İşbank has proven to be a highly capable institution by originating foreign currency financing in 2009, despite the global crisis. The Bank has provided a total of USD 605 million and EUR 518.8 million as a result of two syndicated loans.

- In 2009, İşbank continued to expand its branch network. As of year-end 2009, İşbank provides services at 1,078 domestic and 15 international branches with over 22,000 employees.

- İşbank saw 61.2% of its banking transactions in 2009 performed via alternative distribution channels. The number of ATMs, the most common alternative distribution channel of İşbank, reached 3,591 at year-end 2009.

- İşbank’s web site, “isbank.com.tr” won the “Outstanding Web Site” award at the Internet Advertising Competition (IAC), one of the most prestigious online advertising competitions.

- İşbank continued to provide its customers with innovative and value added products and services in 2009.

- İşbank diligently continued its social responsibility projects within the scope of “sharing with society and participation” principles in 2009. “Chess,” “81 Students from 81 Cities,” “Show Your Report Card, Get Your Book,” “81 Forests in 81 Cities” are just a selection of İşbank’s social responsibility projects.

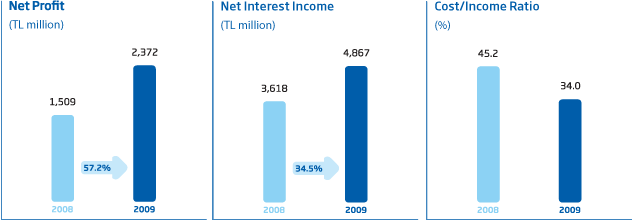

Increasing its net interest income by 34.5%, İşbank achieved a rise of 57.2 % in its net profit in 2009.

(*) Market shares are based upon the monthly sectoral data (including participation banks, and development and investment banks) published by the Banking Regulation and Supervision Agency and are calculated excluding interest accruals and rediscounts.